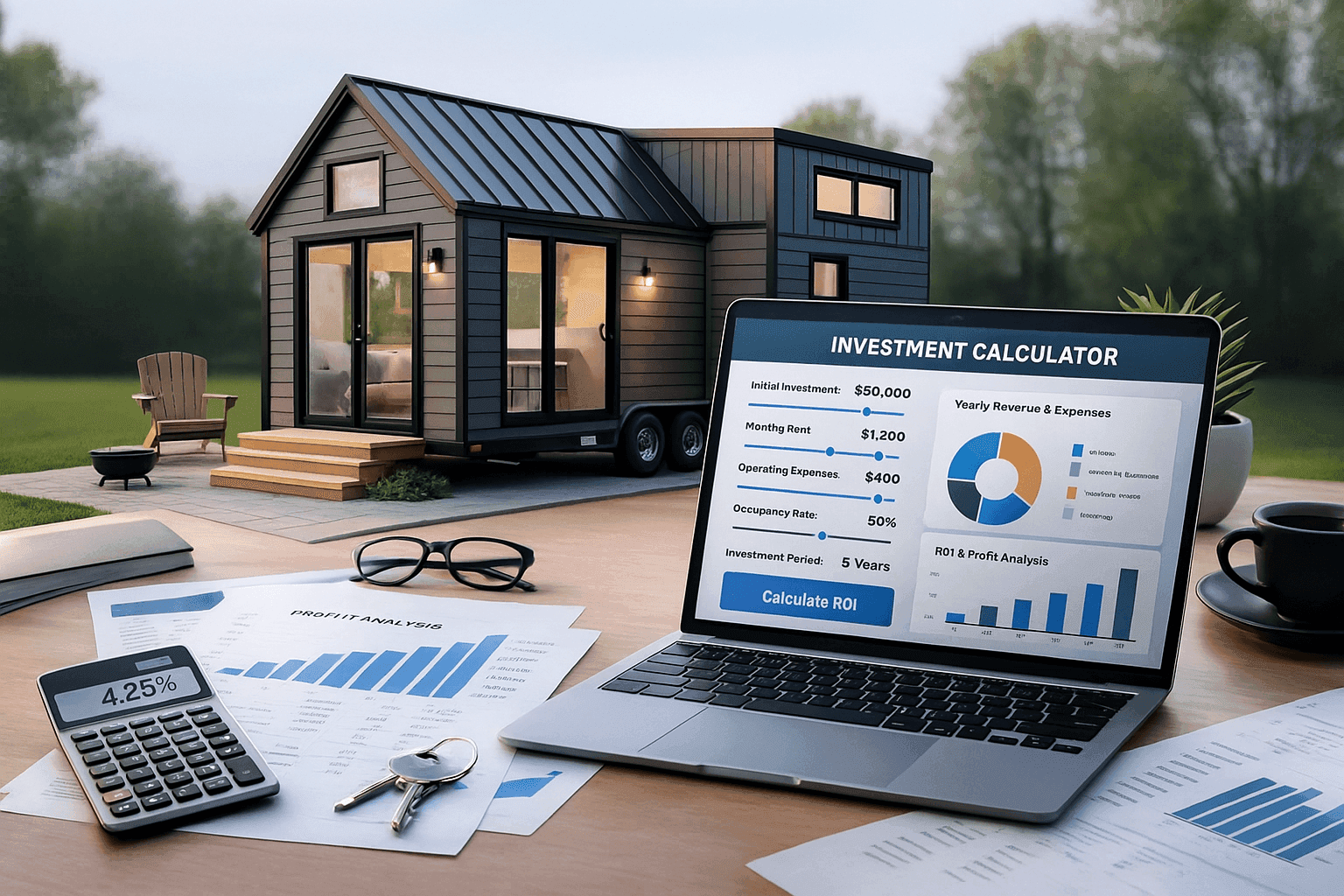

Free Tiny House Investment Calculator

Calculate potential rental income and investment returns for tiny house properties. Estimate yearly revenue, operating costs, and profitability for short-term vacation rentals or long-term housing investments. Looking for properties? Browse our tiny house listings or explore tiny house communities with rental opportunities.

Free investment planning tool • Updated November 2025

Calculate Your Returns

Adjust the inputs below to model different rental scenarios and see projected annual revenue, costs, and profit potential.

45% occupancy rate

Includes cleaning, supplies, utilities, and maintenance per booking

Set to $0 if property is paid off

Projected annual profit of $20,100 based on 165 nights (45% occupancy) at $220/night across 1 property.

Why Invest in Tiny House Rentals?

Lower Entry Costs

Tiny houses cost $50,000-$150,000 compared to $200,000+ for traditional investment properties. Lower acquisition costs mean faster break-even points and higher percentage returns on investment.

High Nightly Rates

Tiny house vacation rentals command premium rates ($150-300+/night) due to novelty factor and tourist appeal. Unique properties generate strong Airbnb/VRBO bookings in popular destinations.

Growing Demand

Housing affordability crisis creates strong demand for affordable rentals. Tourists seek unique accommodations. Tiny houses fill both long-term housing and short-term vacation rental markets.

Scalable Portfolio

Lower unit costs enable multi-property portfolios. Place multiple tiny houses on one parcel to maximize land use. Diversify income across properties and rental strategies.

Lower Maintenance

Smaller spaces mean lower utility bills, faster cleaning turnovers, and reduced maintenance costs. Less square footage translates to lower expenses per booking.

Market Flexibility

Switch between short-term vacation rentals and long-term housing based on market conditions. Tiny houses on wheels can relocate to different markets if needed.

Tiny House Rental Strategies

Short-Term Vacation Rentals

List on Airbnb, VRBO, or Glamping Hub for nightly bookings. Best for tourist destinations, near national parks, wine country, beaches, or unique locations.

Revenue potential: $150-300+/night • Typical occupancy: 50-70% • Best for: High-tourism areas

Long-Term Housing Rentals

Provide affordable housing with 6-12 month leases. Ideal for areas with housing shortages, near universities, or in high-cost housing markets.

Revenue potential: $800-1,500/month • Typical occupancy: 90-100% • Best for: Stable income, less management

Backyard ADU Rentals

Place tiny house on existing residential property as accessory dwelling unit. Generate income from underutilized backyard space.

Revenue potential: $700-1,200/month • Typical occupancy: 90-100% • Best for: Homeowners with land

Tiny House Resort/Village

Create cluster of tiny houses on single property for boutique resort experience. Offer multiple units with shared amenities.

Revenue potential: $200-400+/night per unit • Typical occupancy: 60-80% • Best for: Premium locations, experience seekers

Frequently Asked Questions

Can you make money renting out tiny houses?

Yes, tiny houses can generate strong rental income. Short-term vacation rentals in popular areas often earn $150-300+ per night with 50-70% occupancy. Long-term rentals provide steady income of $800-1,500/month. Success depends on location, property quality, legal compliance, and marketing.

What is a good ROI for a tiny house investment?

Strong tiny house investments typically achieve 10-20% annual ROI. Short-term vacation rentals in high-demand areas can exceed 20% ROI. Long-term rentals typically yield 8-12% ROI. Lower acquisition costs often enable higher percentage returns compared to traditional rental properties.

What are the operating costs?

Operating costs include: cleaning fees ($40-80 per turnover), utilities ($50-150/month), property management (20-30% of revenue), insurance ($800-1,500/year), maintenance (5-10% of revenue), listing fees (3-15%), and supplies. Budget 35-50% of gross revenue for total operating expenses.

How many days per year do rentals stay booked?

Occupancy varies by location: High-demand tourist areas (60-80% or 220-290 nights/year), mid-tier markets (40-60% or 145-220 nights), lower-demand areas (25-40% or 90-145 nights). Strong marketing, competitive pricing, and excellent reviews significantly impact booking rates.

Important Disclaimer

This calculator provides estimates only and should not be considered investment or financial advice. Actual rental income, occupancy rates, and operating costs vary significantly based on location, seasonality, property quality, marketing effectiveness, competition, regulations, management quality, and many other factors. Always verify local zoning laws allow short-term rentals before investing. Consult with licensed financial advisors, tax professionals, and real estate attorneys before making any investment decisions.