ADUs increase property value. Research from Freddie Mac shows that properties with ADUs sell for 20 to 35 percent more than comparable properties without ADUs. The increase depends on local rental markets and housing demand.

Return on investment typically ranges from 80 to 100 percent. If you spend $120,000 building an ADU, your property value might increase by $100,000 to $150,000. In high-demand markets like California and the Pacific Northwest, some ADUs return more than their construction cost at resale.

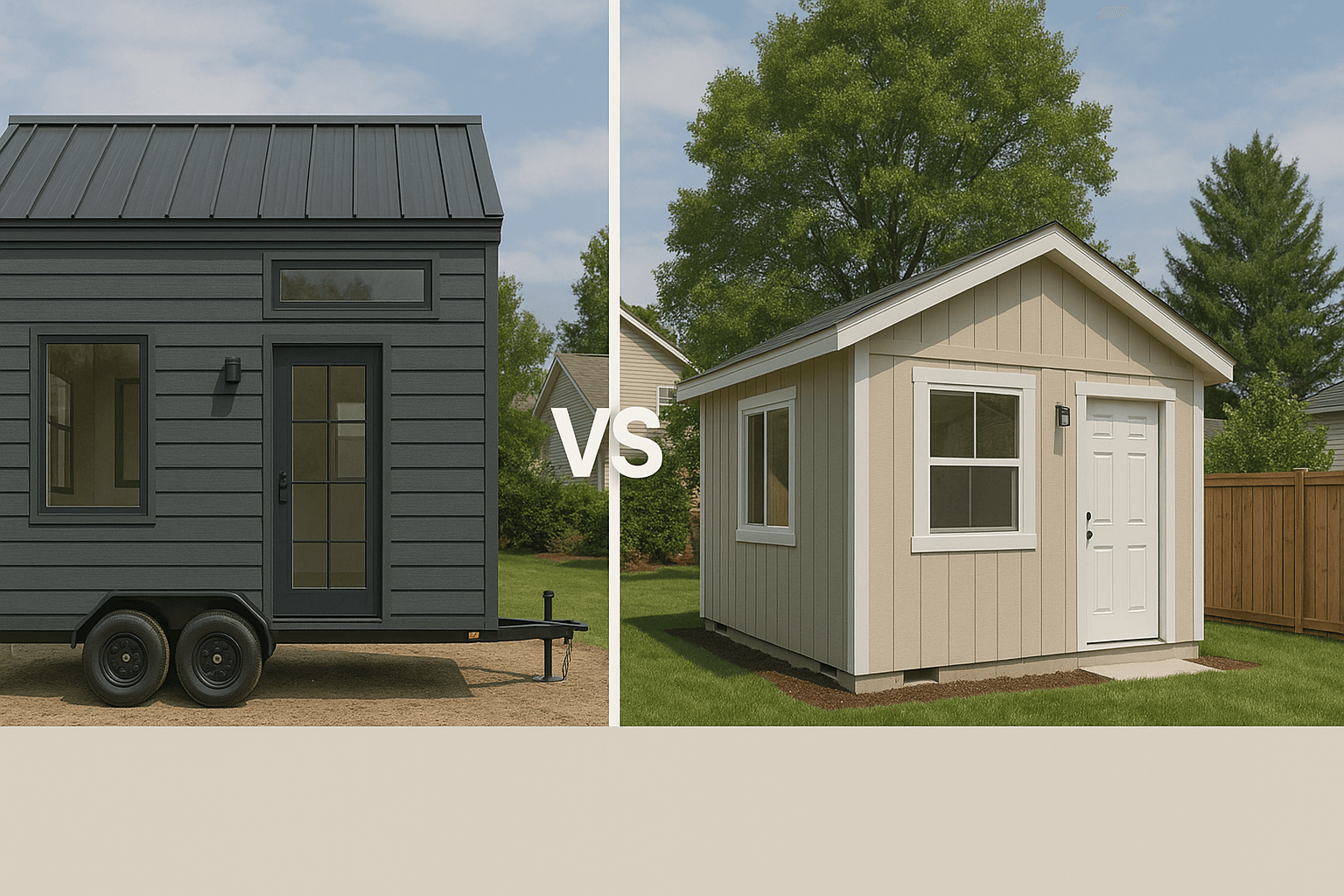

Tiny houses on wheels do not add to property value. Because they are personal property like a car or RV, they are not included in property appraisals. When you sell your property, the tiny house has no impact on sale price unless the buyer wants to purchase it separately.

However, both ADUs and tiny houses can generate rental income. This matters more for cash flow than resale value. Short-term rentals on Airbnb earn $100 to $250 per night in most markets. Long-term rentals earn $800 to $2,500 per month depending on location and size.

The tax implications differ too. ADU rental income is reported on Schedule E like any rental property. You can deduct mortgage interest, property taxes, maintenance, and depreciation. Tiny house rental income is also taxable but without the property tax deduction since you do not own the land separately.

Property taxes increase with ADUs since they add assessed value. Expect property taxes to rise by $1,000 to $3,000 annually depending on your local tax rate and the ADU value. Tiny houses on wheels do not increase property taxes but may require annual vehicle registration fees.

For pure investment return, ADUs win for property owners. For flexibility without property tax increases, tiny houses on wheels offer advantages. Calculate potential rental income with our Investment Calculator.